Book – Rich Dad’s Cash Flow Quadrant (Guide to Financial Freedom) (Summary)

Author – Robert Kiyosaki

Genre – Non-Fiction, Entrepreneurship, Investing

Published in – 1998

Rich Dad’s Cash flow quadrant is in many ways a sequence to Rich Dad Poor Dad, taking financial education further, distinguishing people into four categories by which they generate income.

Even though we’re all human beings, we all respond differently regarding money and the emotions attached to cash it. And it’s how we react to those emotions often determines which quadrant we choose to generate our income from.

About the Book –

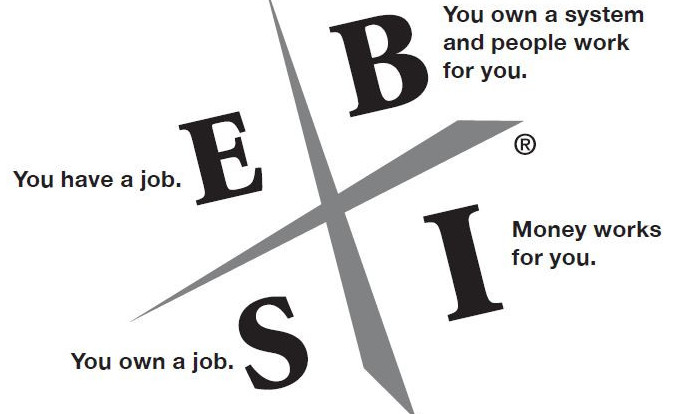

The CASHFLOW Quadrant is a way to categorize people based on where they generate income from. There are four quadrants, and a person can be in more than one quadrant simultaneously.

E – Employee (Full-time Job, working for someone else for a paycheck)

S – Small Business or Self-Employed (Professional like doctor, lawyer, accountant running independent practice)

B – Business (Owns a business system and leverages other people’s time, money, and skill)

I – Investor (Invest money in cash-generating assets, businesses for profit sharing)

Roberts claims though financial freedom can be attained in all four quadrants, Roberts suggests moving to the right side of the quadrant to become truly financially free.

The book is divided into three parts. Part I – The core differences between people in the four quadrants. Part II – Bringing out the Best in Us -is about personal change—part III – The Seven Steps to Finding Your Financial Fast Track.

Here are excerpts from each part –

Part I – Core Values of People in each Quadrant

Robert discusses the core values of people in each quadrant, their beliefs about money, and how to identify them through their words in Part I.

1) Different Quadrant –

- Which quadrant you or I choose to earn our primary income from depends not so much on what we learned in school. It’s more about who we are at our core values, strengths, weaknesses, and interests. These core differences attract us to or repel us from, each quadrant.

- It is important to note that you can be rich or poor in all four quadrants. Being in one quadrant or another does not necessarily guarantee financial success.

2) Identify People in Different Quadrants –

It’s through the words we can get the core value of the person in each quadrant –

- E – I seek a safe, secure job with good pay and excellent benefits.

- S – I can’t find people who want to work and do the job right.” Or “I’ve got more than 20 hours into this project.”

- B – I’m looking for a new president to run my company.

- I – Is my cash flow based on an internal or net rate of return?

3) Why People Choose Security Over Freedom –

- Many people seek job security because that’s what they are taught to seek at school and home. As adults, millions of people continue to follow that advice.

- The reality is that your boss’s job is not to make you rich. Your boss’s job is to make sure you get your paycheck. It’s your job to become wealthy if you want to.

4) The 5 Level of Investor –

Poor says Investing is risky, while Rich says Being financially uneducated is risky. Robert describes five levels of investors.

Level 1 – The Zero Financial Intelligence Level –

- Many people who make a lot of money fall into this category. They earn a lot—and spend more than they deserve. They leave nothing to invest.

Level 2 – The Savers are Losers Level –

- Many people believe it is wise to save money. The problem is that today, “money” is no longer money. Today, people are saving counterfeit dollars, money that can be created at the speed of light.

Level 3 – The “I am too busy” level –

- This is the investor who is too busy to learn about investing. Many investors at this level are highly educated people who are too busy with their careers, family, other interests, and vacations.

- Hence, they prefer to remain financially naïve and turn their money over to someone else to manage for them.

Level 4 – I am a professional investor –

- This investor may buy and sell a few stocks, often from a discount broker. After all, why should they pay a stockbroker’s higher commissions when they can do their research and make their own decisions?

- The Level-4 investor is the do-it-yourselfer from the S quadrant investing in the quadrant.

Level 5 – The Capitalist Level –

- This is the wealthiest level. The Level-5 capitalist investor is a business owner from the B quadrant investing in the quadrant.

- They invest other people’s money, primarily banks, which have gathered this money from level 2 and 3 types.

Part II – Bringing The Best In You

- Keep striving, and you’ll become somebody. Quit, and you’ll become somebody, but not the same person.

- The real issue is the internal change you must go through and who you become. For some people, the process is easy. For others, the journey is impossible.

- It’s this internal battle that makes it so hard. The struggle between who you no longer are and who you want to become is the problem.

- People think that working hard for money and buying things that make them look rich will make them rich. In most cases, it doesn’t. It only makes them more tired. They call it ‘Keeping up with the Joneses.’ And if you notice, the Joneses are exhausted.”

- To be successful as an investor or a business owner, you must be emotionally neutral to winning and losing. Winning and losing are just part of the game.

Part III – How to become successful B and I

This book section describes seven steps to guide you to the right side of the CASHFLOW Quadrant.

Step 1: It’s Time to Mind Your Own Business –

Robert defines minding our business as building our asset column irrespective of our profession, whether we choose to work as E, S, or B. You can keep your day job but make a solid asset column rather than spend all you earn and remain in the “Rat Race” forever.

Step 2: Set Financial Goals & Take Control of Your Cashflow –

- Most people have money problems because they were never schooled in the science of cash flow management.

- More money will not solve the problem if cash flow management is the problem. More money makes most people poorer because they often increase their spending and get deeper into debt every time they get a pay raise.

- Good debt is debt someone else pays for you. Bad debt is debt that you pay for with your sweat and blood. Rich Dad encouraged Robert to buy rental real estate because “the bank gives you the loan, but your tenant pays for it.

Step 3: Know the Difference between Risk & Risky

- Robert claims that business investment is not risky; being uneducated is.

- The one is managing cash flow well has more enormous asset columns and higher income from that asset class than one mismanaging their cash flow.

- Financial literacy is looking at the numbers with your eyes and training your mind to tell you how the cash flows. Rich dad often said, “The direction of cash flow is everything.

Step 4: Decide What Kind of Investor You Want To Be –

Apart from the five levels of investors, Robert also put one more distinction with three kinds of investors.

• Type-C investors are financially uneducated and look for people to tell them what to invest in.

• Type-B investors seek answers. They should interview several tax advisors, attorneys, stockbrokers, and real estate agents, choose carefully, and implement their advice.

• Type-A investors look for problems caused by those who get into financial trouble. They are typically Level-5 investors with solid economic foundations.

Step 5: Seek Mentors –

- A mentor tells you what is essential and what is not necessary.

- Just as there are mentors who are excellent role models, there are people who are wrong role models. In most instances, we all have both types in our lives.

Step 6: Make Disappointment Your Strength –

The size of your success is measured by the strength of your desire, your dream, and how you handle disappointment.

Step 7: The Power of Faith –

- For those of you who are considering embarking on your own financial Fast Track, you may have some doubts about your abilities.

- Trust that you have everything you need right now to be successful financially. All it takes to bring out your natural, God-given gifts is your desire, determination, and deep faith that you have a unique genius and talent.

I have also created a video of a few quotes from the book – I hope you like it. Please subscribe to my YouTube channel – Myread4change.

Conclusion –

Rich Dad’s cashflow quadrant will help you identify which quadrant you are in and help you move or operate in more than one quadrant to attain financial freedom.

You will come face to face with your core values about money and your belief about work preference.

If you like this book, you will also like The Millionaire Next Door and The Psychology of Money.

I hope this summary helped you understand what to expect from the book.

I wish] you a Financially Stable/Free life.

Thank you for Reading.

Muzammil

Great site you’ve got here. It’s difficult to find high-quality writing like yours these days. I truly appreciate individuals like you! Take care!!

You ought to take part in a contest for one of the finest blogs on the internet. I will recommend this site!

It’s difficult to find educated people in this particular subject, but you seem like you know what you’re talking about! Thanks

I want to thank you for this great read!! I certainly loved every bit of it. I have got you bookmarked to look at new stuff you post…

It’s nearly impossible to find knowledgeable people on this subject, however, you seem like you know what you’re talking about! Thanks

bookmarked!!, I like your site!

Good post. I learn something totally new and challenging on sites I stumble upon everyday. It’s always exciting to read through content from other authors and practice something from other web sites.

I really like your WordPress design, wherever would you down load it through?

We are a gaggle of volunteers and starting a brand new scheme in our community. Your web site provided us with valuable info to paintings on. You have performed a formidable process and our whole neighborhood will probably be grateful to you.

Somebody essentially help to make seriously posts I would state. This is the very first time I frequented your website page and thus far? I amazed with the research you made to create this particular publish incredible. Fantastic job!

I have figured out some new issues from your web site about desktops. Another thing I have always presumed is that computer systems have become something that each family must have for many people reasons. They provide convenient ways in which to organize the home, pay bills, shop, study, tune in to music and also watch television shows. An innovative approach to complete all of these tasks is a laptop computer. These pcs are mobile, small, robust and lightweight.

The crux of your writing while appearing reasonable at first, did not really sit very well with me personally after some time. Somewhere throughout the paragraphs you actually were able to make me a believer but only for a while. I however have got a problem with your leaps in assumptions and one would do well to help fill in those breaks. In the event you actually can accomplish that, I will certainly end up being impressed.

hello! I like your writing very much! share we communicate more about your post on AOL? I need an expert on this area to solve my problem. May be that’s you! Looking forward to see you.

I’m in awe of the author’s ability to make intricate concepts approachable to readers of all backgrounds. This article is a testament to her expertise and dedication to providing valuable insights. Thank you, author, for creating such an engaging and enlightening piece. It has been an incredible joy to read!

Hey there! Do you know if they make any plugins to help with Search Engine Optimization? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good success. If you know of any please share. Cheers!

Thank you, I’ve recently been searching for details about this subject matter for ages and yours is the best I have found so far.

I’ve recently started a web site, the info you provide on this website has helped me greatly. Thanks for all of your time & work.

Thank you for another excellent post. The place else may anyone get that kind of info in such a perfect method of writing? I’ve a presentation subsequent week, and I’m on the look for such info.

One other issue is when you are in a situation where you do not possess a cosigner then you may want to try to wear out all of your financing options. You can get many awards and other scholarship grants that will supply you with money to aid with classes expenses. Thx for the post.

I am curious to find out what blog platform you happen to be working with? I’m experiencing some minor security issues with my latest website and I’d like to find something more risk-free. Do you have any solutions?

Hi there! I could have sworn I’ve been to this blog before but after reading through some of the post I realized it’s new to me. Nonetheless, I’m definitely delighted I found it and I’ll be book-marking and checking back frequently!

I have noticed that car insurance companies know the cars and trucks which are susceptible to accidents along with risks. Additionally, these people know what type of cars are susceptible to higher risk as well as the higher risk they’ve got the higher your premium rate. Understanding the simple basics of car insurance will assist you to choose the right kind of insurance policy that could take care of the needs you have in case you get involved in an accident. Thanks for sharing your ideas on your own blog.

Thanks , I have just been searching for info approximately this topic for a long time and yours is the best I’ve discovered so far. However, what concerning the conclusion? Are you certain in regards to the supply?

Does your site have a contact page? I’m having a tough time locating it but, I’d like to send you an e-mail. I’ve got some suggestions for your blog you might be interested in hearing. Either way, great website and I look forward to seeing it develop over time.

I’ve been surfing online more than 3 hours nowadays, yet I never found any interesting article like yours. It?s pretty worth sufficient for me. Personally, if all webmasters and bloggers made good content material as you probably did, the net will be much more helpful than ever before.

I have noticed that of all sorts of insurance, medical care insurance is the most questionable because of the conflict between the insurance policy company’s obligation to remain adrift and the consumer’s need to have insurance. Insurance companies’ commission rates on overall health plans are very low, therefore some providers struggle to make money. Thanks for the tips you discuss through this website.

Wow, superb weblog structure! How lengthy have you been blogging for? you make running a blog look easy. The full look of your site is wonderful, as neatly as the content material!

Something more important is that when evaluating a good on the internet electronics store, look for online stores that are continuously updated, preserving up-to-date with the hottest products, the most beneficial deals, plus helpful information on services. This will ensure that you are handling a shop which stays over the competition and provides you what you ought to make educated, well-informed electronics buying. Thanks for the vital tips I’ve learned from your blog.

Hey there! This is my first visit to your blog! We are a collection of volunteers and starting a new project in a community in the same niche. Your blog provided us useful information to work on. You have done a marvellous job!

I think this is one of the most vital information for me. And i am glad reading your article. But wanna remark on few general things, The web site style is ideal, the articles is really nice : D. Good job, cheers

After research a number of of the blog posts in your web site now, and I actually like your approach of blogging. I bookmarked it to my bookmark web site listing and can be checking again soon. Pls take a look at my web page as well and let me know what you think.

Thanks for your post. I also think that laptop computers are getting to be more and more popular currently, and now are often the only kind of computer utilized in a household. It is because at the same time potentially they are becoming more and more reasonably priced, their working power keeps growing to the point where they can be as potent as pc’s through just a few years ago.

Really appreciate you sharing this blog post.Thanks Again. Really Cool.

Magnificent beat ! I would like to apprentice even as you amend your website, how can i subscribe for a weblog website? The account helped me a appropriate deal. I were tiny bit acquainted of this your broadcast offered brilliant transparent idea

excellent post, very informative. I wonder why the other specialists of this sector don’t notice this. You should continue your writing. I’m sure, you’ve a great readers’ base already!

Thank you for this article. I would also like to convey that it can become hard when you’re in school and simply starting out to initiate a long history of credit. There are many college students who are only trying to live and have a lengthy or favourable credit history can sometimes be a difficult element to have.

great post, very informative. I wonder why the other experts of this sector don’t notice this. You should continue your writing. I’m sure, you have a huge readers’ base already!

Thanks for your information on this blog. A single thing I want to say is always that purchasing electronic devices items on the Internet is certainly not new. The fact is, in the past few years alone, the market for online consumer electronics has grown noticeably. Today, you will find practically almost any electronic device and product on the Internet, from cameras as well as camcorders to computer parts and games consoles.

I have realized that of all types of insurance, health insurance coverage is the most debatable because of the issue between the insurance coverage company’s necessity to remain afloat and the customer’s need to have insurance policy. Insurance companies’ earnings on wellness plans have become low, as a result some businesses struggle to make a profit. Thanks for the ideas you reveal through this blog.

I have observed that of all different types of insurance, health care insurance is the most questionable because of the discord between the insurance plan company’s duty to remain adrift and the customer’s need to have insurance coverage. Insurance companies’ commissions on health and fitness plans are certainly low, thus some providers struggle to gain profits. Thanks for the ideas you talk about through this site.

This actually answered my downside, thank you!

Oh my goodness! an amazing article dude. Thanks Nevertheless I am experiencing concern with ur rss . Don?t know why Unable to subscribe to it. Is there anybody getting equivalent rss drawback? Anyone who is aware of kindly respond. Thnkx

I think one of your advertisings caused my web browser to resize, you may well want to put that on your blacklist.

We are a group of volunteers and starting a new scheme in our community. Your site offered us with valuable info to work on. You’ve done a formidable job and our entire community will be grateful to you.

certainly like your web site but you have to check the spelling on several of your posts. Many of them are rife with spelling problems and I find it very bothersome to tell the truth nevertheless I’ll surely come back again.

I have seen lots of useful points on your web page about personal computers. However, I’ve got the thoughts and opinions that lap tops are still less than powerful adequately to be a good option if you normally do tasks that require lots of power, including video modifying. But for world-wide-web surfing, microsoft word processing, and a lot other prevalent computer functions they are all right, provided you may not mind the screen size. Thank you for sharing your notions.

Hi this is kind of of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding know-how so I wanted to get guidance from someone with experience. Any help would be enormously appreciated!

Hi, Neat post. There’s an issue together with your web site in web explorer, would test this? IE nonetheless is the marketplace chief and a big component to other people will miss your wonderful writing because of this problem.

Thanks for your post. I have often noticed that the majority of people are needing to lose weight simply because wish to appear slim as well as attractive. Nevertheless, they do not generally realize that there are many benefits for losing weight also. Doctors claim that overweight people suffer from a variety of ailments that can be instantly attributed to the excess weight. The great thing is that people who definitely are overweight and also suffering from numerous diseases can reduce the severity of their illnesses simply by losing weight. It is possible to see a slow but marked improvement in health whenever even a moderate amount of fat reduction is obtained.

Would you be focused on exchanging hyperlinks?

I’ve been exploring for a bit for any high-quality articles or weblog posts in this sort of house . Exploring in Yahoo I eventually stumbled upon this website. Studying this information So i am satisfied to exhibit that I have a very excellent uncanny feeling I found out just what I needed. I such a lot unquestionably will make sure to do not put out of your mind this web site and provides it a look on a relentless basis.

Excellent blog! Do you have any helpful hints for aspiring writers? I’m planning to start my own blog soon but I’m a little lost on everything. Would you suggest starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m totally confused .. Any recommendations? Appreciate it!

Thanks for your intriguing article. One other problem is that mesothelioma is generally brought on by the breathing of material from mesothelioma, which is a very toxic material. It can be commonly viewed among individuals in the construction industry who may have long exposure to asbestos. It is also caused by living in asbestos insulated buildings for years of time, Genetics plays a huge role, and some people are more vulnerable to the risk when compared with others.

I truly appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thx again

We are a group of volunteers and opening a brand new scheme in our community. Your website provided us with useful information to paintings on. You’ve performed an impressive activity and our whole group can be grateful to you.

I have learn some just right stuff here. Definitely worth bookmarking for revisiting. I wonder how much attempt you place to create one of these great informative site.

Hello there, I found your site via Google while searching for a related topic, your website came up, it looks great. I have bookmarked it in my google bookmarks.

Thanks for this glorious article. One more thing to mention is that nearly all digital cameras can come equipped with a new zoom lens that permits more or less of the scene to get included by means of ‘zooming’ in and out. These types of changes in {focus|focusing|concentration|target|the a**** length are generally reflected from the viewfinder and on large display screen at the back of any camera.

What’s Happening I’m new to this, I stumbled upon this I’ve found It absolutely helpful and it has helped me out loads. I hope to contribute & assist other users like its aided me. Good job.

Hi, Neat post. There’s a problem with your site in internet explorer, would check this? IE still is the market leader and a good portion of people will miss your excellent writing because of this problem.

I’ve really noticed that credit restoration activity has to be conducted with tactics. If not, chances are you’ll find yourself destroying your ranking. In order to be successful in fixing your credit ranking you have to confirm that from this second you pay all of your monthly dues promptly in advance of their booked date. It is really significant given that by not necessarily accomplishing so, all other steps that you will decide to try to improve your credit standing will not be useful. Thanks for expressing your tips.

Aw, this was a really nice post. In thought I want to put in writing like this moreover ? taking time and actual effort to make an excellent article? but what can I say? I procrastinate alot and by no means appear to get one thing done.

Things i have observed in terms of laptop or computer memory is that there are features such as SDRAM, DDR and the like, that must match the specifications of the motherboard. If the personal computer’s motherboard is rather current and there are no computer OS issues, changing the memory literally usually takes under a couple of hours. It’s one of many easiest personal computer upgrade types of procedures one can picture. Thanks for expressing your ideas.

Hello, you used to write fantastic, but the last few posts have been kinda boring? I miss your great writings. Past few posts are just a little out of track! come on!

I have taken note that of all kinds of insurance, health insurance is the most marked by controversy because of the clash between the insurance policy company’s obligation to remain adrift and the buyer’s need to have insurance plan. Insurance companies’ commission rates on well being plans are incredibly low, hence some providers struggle to make a profit. Thanks for the thoughts you discuss through this blog.

Wonderful website. Lots of useful information here. I am sending it to a few friends and also sharing in delicious. And certainly, thanks for your effort!

I have figured out some essential things through your website post. One other subject I would like to mention is that there are plenty of games that you can buy which are designed especially for preschool age small children. They contain pattern acceptance, colors, family pets, and patterns. These normally focus on familiarization rather than memorization. This will keep children and kids engaged without having the experience like they are studying. Thanks

Hi there just wanted to give you a quick heads up. The text in your content seem to be running off the screen in Firefox. I’m not sure if this is a formatting issue or something to do with browser compatibility but I figured I’d post to let you know. The layout look great though! Hope you get the problem fixed soon. Kudos

After study a number of of the weblog posts in your web site now, and I really like your approach of blogging. I bookmarked it to my bookmark website listing and shall be checking back soon. Pls take a look at my website as well and let me know what you think.

Woah! I’m really digging the template/theme of this blog. It’s simple, yet effective. A lot of times it’s hard to get that “perfect balance” between superb usability and appearance. I must say you’ve done a amazing job with this. In addition, the blog loads super quick for me on Firefox. Superb Blog!

I just like the helpful info you supply on your articles. I will bookmark your weblog and take a look at once more here frequently. I’m relatively certain I?ll be informed a lot of new stuff right right here! Good luck for the following!

One thing I would like to say is the fact that before obtaining more computer memory, consider the machine in to which it could be installed. In the event the machine can be running Windows XP, for instance, the particular memory ceiling is 3.25GB. Applying above this would simply constitute just a waste. Be sure that one’s mother board can handle this upgrade volume, as well. Thanks for your blog post.

I have discovered some new elements from your site about desktops. Another thing I have always presumed is that laptop computers have become something that each family must have for many people reasons. They supply you with convenient ways in which to organize homes, pay bills, go shopping, study, hear music and in some cases watch tv shows. An innovative method to complete most of these tasks is a laptop. These pcs are mobile, small, highly effective and transportable.

Heya i am for the first time here. I found this board and I find It really useful & it helped me out much. I hope to give something back and aid others like you aided me.

Hiya, I’m really glad I have found this information. Nowadays bloggers publish just about gossips and internet and this is actually annoying. A good blog with exciting content, this is what I need. Thanks for keeping this website, I’ll be visiting it. Do you do newsletters? Can not find it.

Hello, you used to write wonderful, but the last several posts have been kinda boring? I miss your super writings. Past few posts are just a bit out of track! come on!

Thanks for your article. I would love to say that your health insurance dealer also works best for the benefit of the actual coordinators of your group insurance. The health broker is given a directory of benefits looked for by an individual or a group coordinator. What a broker may is look for individuals or perhaps coordinators that best complement those demands. Then he provides his recommendations and if each party agree, the particular broker formulates an agreement between the two parties.

Hey There. I found your blog the use of msn. This is a really smartly written article. I’ll make sure to bookmark it and return to learn extra of your useful info. Thank you for the post. I will certainly comeback.

Hi very nice web site!! Guy .. Excellent .. Wonderful .. I will bookmark your website and take the feeds also? I’m happy to seek out numerous useful information right here in the submit, we need develop extra strategies on this regard, thank you for sharing. . . . . .

Have you ever considered about including a little bit more than just your articles? I mean, what you say is fundamental and all. Nevertheless think about if you added some great visuals or videos to give your posts more, “pop”! Your content is excellent but with pics and clips, this site could undeniably be one of the best in its field. Awesome blog!

Aw, this was a really nice post. In concept I wish to put in writing like this additionally ? taking time and precise effort to make an excellent article? but what can I say? I procrastinate alot and on no account seem to get one thing done.

I have realized that of all varieties of insurance, health care insurance is the most debatable because of the clash between the insurance cover company’s need to remain adrift and the consumer’s need to have insurance plan. Insurance companies’ income on well being plans are certainly low, hence some organizations struggle to profit. Thanks for the tips you share through your blog.

I can’t express how much I admire the effort the author has put into producing this remarkable piece of content. The clarity of the writing, the depth of analysis, and the wealth of information offered are simply impressive. Her zeal for the subject is apparent, and it has definitely resonated with me. Thank you, author, for offering your knowledge and enhancing our lives with this exceptional article!

Bookmark your blog and check again here frequently. I am quite certain I will learn many new stuff right here! Best of luck for the next!

I know this if off topic but I’m looking into starting my own weblog and was wondering what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very web smart so I’m not 100 positive. Any recommendations or advice would be greatly appreciated. Many thanks

I know this if off topic but I’m looking into starting my own weblog and was curious what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet smart so I’m not 100 certain. Any tips or advice would be greatly appreciated. Thanks

I have been surfing on-line more than three hours today, but I by no means found any interesting article like yours. It?s beautiful price sufficient for me. Personally, if all site owners and bloggers made good content as you probably did, the internet might be much more helpful than ever before.

What an informative and meticulously-researched article! The author’s meticulousness and aptitude to present complex ideas in a comprehensible manner is truly praiseworthy. I’m extremely enthralled by the scope of knowledge showcased in this piece. Thank you, author, for sharing your wisdom with us. This article has been a real game-changer!

What’s Happening i’m new to this, I stumbled upon this I’ve found It positively useful and it has helped me out loads. I hope to contribute & aid other users like its helped me. Great job.

Hiya very cool web site!! Man .. Excellent .. Superb .. I’ll bookmark your blog and take the feeds additionally?I’m glad to search out numerous useful info right here in the put up, we need work out more strategies in this regard, thank you for sharing. . . . . .

Hi my friend! I want to say that this post is awesome, nice written and include approximately all significant infos. I would like to peer extra posts like this .

I don’t even know how I ended up here, but I thought this post was great. I do not know who you are but certainly you’re going to a famous blogger if you are not already 😉 Cheers!

I was very pleased to seek out this web-site.I needed to thanks in your time for this excellent read!! I definitely enjoying each little bit of it and I have you bookmarked to take a look at new stuff you weblog post.

Generally I don’t learn post on blogs, but I would like to say that this write-up very forced me to try and do it! Your writing style has been surprised me. Thank you, very nice post.

Undeniably believe that which you said. Your favorite justification seemed to be on the net the easiest thing to take note of. I say to you, I certainly get irked even as other people think about issues that they just don’t know about. You controlled to hit the nail upon the highest and defined out the entire thing with no need side-effects , other people can take a signal. Will likely be again to get more. Thank you

I love your wordpress web template, exactly where would you download it through?

It is Generate Press Theme free version. I got from Themes.

My brother recommended I would possibly like this web site. He used to be entirely right. This submit actually made my day. You cann’t believe simply how much time I had spent for this info! Thank you!

Thanks for enabling me to acquire new strategies about pc’s. I also have belief that certain of the best ways to keep your laptop computer in leading condition has been a hard plastic-type case, and also shell, that suits over the top of one’s computer. These kinds of protective gear are usually model targeted since they are made to fit perfectly across the natural casing. You can buy them directly from the owner, or from third party places if they are readily available for your notebook, however only a few laptop can have a cover on the market. All over again, thanks for your guidelines.

I’m really impressed with your writing abilities as well as with the layout in your weblog. Is that this a paid theme or did you modify it yourself? Either way stay up the excellent quality writing, it?s rare to look a nice blog like this one today..

Thanks for your write-up. I also believe that laptop computers have gotten more and more popular lately, and now in many cases are the only sort of computer employed in a household. This is because at the same time that they are becoming more and more very affordable, their processing power is growing to the point where they may be as powerful as personal computers out of just a few years ago.

Unquestionably imagine that that you said. Your favourite justification appeared to be on the net the easiest thing to understand of. I say to you, I definitely get irked whilst other folks consider worries that they plainly don’t recognise about. You controlled to hit the nail upon the top and also outlined out the whole thing with no need side effect , other people could take a signal. Will likely be again to get more. Thank you

It is appropriate time to make some plans for the future and it is time to be happy. I’ve read this post and if I could I want to suggest you few interesting things or suggestions. Maybe you can write next articles referring to this article. I desire to read even more things about it!

Browse through our impressive selection of porn videos in HD quality on any device you own

A few things i have observed in terms of pc memory is there are specs such as SDRAM, DDR and the like, that must match up the requirements of the mother board. If the pc’s motherboard is pretty current while there are no computer OS issues, modernizing the memory literally requires under an hour or so. It’s one of many easiest laptop upgrade methods one can envision. Thanks for sharing your ideas.

One more thing. It’s my opinion that there are several travel insurance web sites of dependable companies that let you enter holiday details and acquire you the rates. You can also purchase the actual international travel cover policy on internet by using your current credit card. Everything you need to do will be to enter your current travel particulars and you can be aware of the plans side-by-side. Just find the plan that suits your financial allowance and needs after which use your bank credit card to buy the item. Travel insurance on the internet is a good way to do investigation for a dependable company pertaining to international travel insurance. Thanks for discussing your ideas.

I’m amazed by the quality of this content! The author has clearly put a huge amount of effort into investigating and organizing the information. It’s exciting to come across an article that not only provides helpful information but also keeps the readers engaged from start to finish. Great job to him for producing such a brilliant work!

Hello, i think that i saw you visited my web site so i came to ?return the favor?. I am trying to find things to improve my website! I suppose its ok to use some of your ideas!!

Thanks for your posting. One other thing is when you are selling your property by yourself, one of the challenges you need to be mindful of upfront is just how to deal with household inspection reviews. As a FSBO vendor, the key towards successfully moving your property plus saving money about real estate agent commission rates is knowledge. The more you already know, the simpler your property sales effort will be. One area exactly where this is particularly crucial is assessments.

Thanks for your information on this blog. 1 thing I wish to say is the fact that purchasing electronic products items over the Internet is not new. The truth is, in the past few years alone, the market for online consumer electronics has grown noticeably. Today, you will find practically just about any electronic system and devices on the Internet, including cameras and also camcorders to computer elements and gambling consoles.

naturally like your web-site but you have to check the spelling on several of your posts. Many of them are rife with spelling issues and I find it very bothersome to tell the truth nevertheless I?ll definitely come back again.

It’s exhausting to seek out knowledgeable individuals on this topic, however you sound like you recognize what you?re speaking about! Thanks

Admiring the time and energy you put into your blog and in depth information you present. It’s good to come across a blog every once in a while that isn’t the same out of date rehashed information. Wonderful read! I’ve saved your site and I’m including your RSS feeds to my Google account.

It’s really a great and useful piece of info. I am glad that you shared this helpful info with us. Please keep us up to date like this. Thank you for sharing.

I’m not sure where you are getting your information, but great topic. I needs to spend some time learning much more or understanding more. Thanks for great information I was looking for this information for my mission.

Heya i am for the primary time here. I came across this board and I find It really useful & it helped me out a lot. I hope to give something back and aid others such as you aided me.

Hello! Do you know if they make any plugins to assist with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good success. If you know of any please share. Appreciate it!

I’d have to verify with you here. Which isn’t one thing I often do! I take pleasure in reading a submit that can make folks think. Additionally, thanks for allowing me to remark!

A lot of of what you articulate happens to be supprisingly accurate and that makes me ponder why I hadn’t looked at this with this light previously. This particular piece truly did switch the light on for me personally as far as this particular subject goes. Nonetheless there is just one position I am not too cozy with and while I make an effort to reconcile that with the actual central idea of your position, let me see just what the rest of your subscribers have to say.Nicely done.

That is very fascinating, You are a very skilled blogger. I’ve joined your rss feed and sit up for looking for extra of your excellent post. Also, I’ve shared your site in my social networks!

great issues altogether, you simply gained a logo new reader. What would you suggest about your post that you made a few days in the past? Any certain?

I was suggested this website by my cousin. I’m not sure whether this post is written by him as nobody else know such detailed about my trouble. You are amazing! Thanks!

Hiya! I just want to give a huge thumbs up for the great information you have got here on this post. I shall be coming again to your weblog for extra soon.

Furthermore, i believe that mesothelioma is a extraordinary form of cancer that is often found in these previously familiar with asbestos. Cancerous cells form while in the mesothelium, which is a safety lining which covers a lot of the body’s body organs. These cells commonly form in the lining of your lungs, stomach, or the sac that encircles one’s heart. Thanks for giving your ideas.

Valuable info. Lucky me I found your website by accident, and I’m shocked why this accident didn’t happened earlier! I bookmarked it.

Hi there very nice web site!! Man .. Excellent .. Superb .. I will bookmark your blog and take the feeds additionally?I’m happy to seek out so many useful information here within the submit, we need develop more techniques on this regard, thanks for sharing. . . . . .

wonderful points altogether, you simply gained a brand new reader. What would you suggest in regards to your post that you made a few days ago? Any positive?

Nice read, I just passed this onto a friend who was doing a little research on that. And he just bought me lunch since I found it for him smile So let me rephrase that: Thank you for lunch!

The subsequent time I learn a weblog, I hope that it doesnt disappoint me as much as this one. I imply, I know it was my option to read, but I actually thought youd have something interesting to say. All I hear is a bunch of whining about one thing that you can fix should you werent too busy looking for attention.

naturally like your web-site but you have to take a look at the spelling on quite a few of your posts. Several of them are rife with spelling problems and I in finding it very bothersome to inform the truth on the other hand I will definitely come back again.

What’s Going down I’m new to this, I stumbled upon this I have found It positively helpful and it has helped me out loads. I’m hoping to give a contribution & assist different customers like its helped me. Great job.

Thanks for one’s marvelous posting! I certainly enjoyed reading it, you’re a great author.I will always bookmark your blog and may come back at some point. I want to encourage continue your great work, have a nice morning!

Thanks, I’ve recently been looking for facts about this subject for ages and yours is the best I’ve discovered so far.

I was suggested this web site by means of my cousin. I am no longer positive whether or not this post is written by him as nobody else realize such specified about my trouble. You’re amazing! Thanks!

This is very attention-grabbing, You’re a very skilled blogger. I’ve joined your rss feed and stay up for looking for extra of your great post. Additionally, I’ve shared your website in my social networks!

Hmm is anyone else experiencing problems with the images on this blog loading? I’m trying to find out if its a problem on my end or if it’s the blog. Any responses would be greatly appreciated.

Hello my friend! I want to say that this post is amazing, nice written and include almost all significant infos. I?d like to see more posts like this.

Can I simply say what a aid to find somebody who actually knows what theyre talking about on the internet. You undoubtedly know how to carry an issue to mild and make it important. Extra folks need to read this and perceive this side of the story. I cant believe youre not more popular since you positively have the gift.

Do you have a spam issue on this website; I also am a blogger, and I was wanting to know your situation; we have developed some nice procedures and we are looking to trade methods with other folks, please shoot me an email if interested.

Wonderful blog! I found it while browsing on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Thanks

wonderful issues altogether, you simply won a emblem new reader. What could you recommend in regards to your post that you made a few days ago? Any certain?

What?s Happening i’m new to this, I stumbled upon this I’ve found It positively helpful and it has aided me out loads. I hope to contribute & assist other users like its aided me. Great job.

Good website! I really love how it is simple on my eyes and the data are well written. I’m wondering how I could be notified whenever a new post has been made. I have subscribed to your feed which must do the trick! Have a great day!

I have read a few just right stuff here. Certainly value bookmarking for revisiting. I surprise how a lot attempt you place to make this type of fantastic informative web site.

This article is absolutely incredible! The author has done a tremendous job of conveying the information in an compelling and enlightening manner. I can’t thank her enough for offering such valuable insights that have undoubtedly enriched my awareness in this topic. Kudos to her for creating such a work of art!

What an informative and well-researched article! The author’s thoroughness and capability to present intricate ideas in a digestible manner is truly commendable. I’m extremely impressed by the depth of knowledge showcased in this piece. Thank you, author, for offering your wisdom with us. This article has been a real game-changer!

I appreciate your wp web template, wherever did you download it from?

Hi! I know this is kind of off topic but I was wondering if you knew where I could locate a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having trouble finding one? Thanks a lot!

I used to be very pleased to find this internet-site.I wanted to thanks on your time for this wonderful learn!! I undoubtedly having fun with each little bit of it and I have you bookmarked to take a look at new stuff you blog post.

Wonderful work! This is the type of info that should be shared around the net. Shame on the search engines for not positioning this post higher! Come on over and visit my website . Thanks =)

I’m really impressed along with your writing skills as well as with the structure on your blog. Is this a paid subject matter or did you customize it your self? Either way keep up the nice quality writing, it?s rare to look a great blog like this one today..

That is the right blog for anybody who needs to search out out about this topic. You understand a lot its nearly onerous to argue with you (not that I actually would want?HaHa). You positively put a brand new spin on a subject thats been written about for years. Nice stuff, just great!

Hey! I’m at work browsing your blog from my new iphone 3gs! Just wanted to say I love reading through your blog and look forward to all your posts! Carry on the superb work!

I think this is one of the most important info for me. And I’m glad reading your article. But should remark on few general things, The web site style is perfect, the articles is really great : D. Good job, cheers

Remarkable things here. I am very glad to see your article. Thanks a lot and i am looking forward to contact you. Will you please drop me a mail?

I would like to thank you for the efforts you’ve put in writing this web site. I am hoping the same high-grade web site post from you in the upcoming as well. Actually your creative writing skills has inspired me to get my own web site now. Actually the blogging is spreading its wings quickly. Your write up is a great example of it.

Hello there, I discovered your website by means of Google whilst searching for a similar topic, your website got here up, it seems great. I have bookmarked it in my google bookmarks.

This is without a doubt one of the greatest articles I’ve read on this topic! The author’s thorough knowledge and enthusiasm for the subject shine through in every paragraph. I’m so grateful for coming across this piece as it has enriched my comprehension and stimulated my curiosity even further. Thank you, author, for investing the time to craft such a remarkable article!

This website can be a stroll-via for all of the info you wished about this and didn?t know who to ask. Glimpse right here, and you?ll positively discover it.

Hello there, just became alert to your blog through Google, and found that it’s really informative. I am going to watch out for brussels. I?ll appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

Hello there, I found your website via Google while searching for a related topic, your site came up, it looks good. I have bookmarked it in my google bookmarks.

An interesting discussion is worth comment. I feel that you must write more on this topic, it might not be a taboo subject however generally individuals are not sufficient to speak on such topics. To the next. Cheers

Magnificent beat ! I would like to apprentice while you amend your website, how could i subscribe for a blog site? The account helped me a acceptable deal. I had been tiny bit acquainted of this your broadcast offered bright clear idea

Spot on with this write-up, I truly suppose this website wants much more consideration. I?ll probably be once more to read way more, thanks for that info.

I’m not sure why but this blog is loading extremely slow for me. Is anyone else having this problem or is it a problem on my end? I’ll check back later and see if the problem still exists.

I have read a few just right stuff here. Definitely price bookmarking for revisiting. I wonder how so much attempt you set to make this kind of magnificent informative site.

I’m really impressed with your writing skills as well as with the layout on your weblog. Is this a paid theme or did you modify it yourself? Anyway keep up the nice quality writing, it’s rare to see a nice blog like this one nowadays..

I am usually to blogging and i actually respect your content. The article has actually peaks my interest. I’m going to bookmark your website and maintain checking for brand new information.

Fantastic beat ! I would like to apprentice while you amend your site, how can i subscribe for a blog site? The account helped me a acceptable deal. I had been tiny bit acquainted of this your broadcast offered bright clear idea

My spouse and I absolutely love your blog and find most of your post’s to be exactly I’m looking for. Would you offer guest writers to write content available for you? I wouldn’t mind composing a post or elaborating on most of the subjects you write regarding here. Again, awesome web log!

I have recently started a site, the info you offer on this website has helped me tremendously. Thanks for all of your time & work.

Awesome things here. I am very satisfied to peer your post. Thanks a lot and I’m taking a look forward to contact you. Will you please drop me a e-mail?

I’m in awe of the author’s ability to make complicated concepts approachable to readers of all backgrounds. This article is a testament to his expertise and passion to providing valuable insights. Thank you, author, for creating such an captivating and illuminating piece. It has been an incredible joy to read!

hi!,I like your writing so much! share we communicate more about your article on AOL? I require an expert on this area to solve my problem. May be that’s you! Looking forward to see you.

I am extremely impressed with your writing abilities and also with the structure in your blog. Is that this a paid theme or did you customize it yourself? Either way keep up the excellent high quality writing, it’s rare to see a great blog like this one these days..

Fantastic items from you, man. I’ve remember

your stuff prior to and you’re simply extremely fantastic.

I actually like what you have received right here,

certainly like what you are saying and the way in which wherein you are saying it.

You’re making it entertaining and you still take care of to keep it sensible.

I cant wait to read far more from you. That is

really a terrific web site.

Do you have a spam issue on this site; I also am a blogger, and I was wanting

to know your situation; we have created some nice practices and

we are looking to trade methods with other folks, be sure to shoot me an e-mail if

interested.

We are a group of volunteers and opening a new scheme in our community.

Your site offered us with valuable information to work on. You

have done a formidable job and our whole community will be thankful to you.

I really like what you guys tend to be up too. Such

clever work and exposure! Keep up the good works guys I’ve included you

guys to blogroll.

Oh my goodness! Impressive article dude! Thanks, However I am going through troubles with your

RSS. I don’t understand the reason why I cannot subscribe to it.

Is there anybody else having the same RSS issues? Anyone that knows the

answer will you kindly respond? Thanx!!

An interesting discussion is price comment. I feel that you should write extra on this subject, it may not be a taboo topic but generally people are not sufficient to speak on such topics. To the next. Cheers

I do consider all the concepts you have introduced in your post. They’re really convincing and can certainly work. Nonetheless, the posts are very brief for novices. Could you please lengthen them a little from subsequent time? Thank you for the post.

This is a terrific web site, will you be interested in doing an interview regarding how you created it? If so e-mail me!

I will immediately grab your rss as I can not find your e-mail subscription link or newsletter service. Do you have any? Please let me know in order that I could subscribe. Thanks.

Hi there, just became aware of your blog through Google, and found that it is truly informative. I’m going to watch out for brussels. I will be grateful if you continue this in future. Numerous people will be benefited from your writing. Cheers!

I’m really enjoying the design and layout of your site. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a designer to create your theme? Great work!

You actually make it seem so easy together with your presentation however I find this matter to be actually one thing which I believe I would never understand. It sort of feels too complicated and very huge for me. I am taking a look ahead on your next submit, I’ll attempt to get the hold of it!

I loved as much as you’ll receive carried out right here. The sketch is tasteful, your authored material stylish. nonetheless, you command get got an shakiness over that you wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly a lot often inside case you shield this increase.

Woah! I’m really enjoying the template/theme of this blog. It’s simple, yet effective. A lot of times it’s very hard to get that “perfect balance” between user friendliness and visual appeal. I must say that you’ve done a awesome job with this. In addition, the blog loads super fast for me on Chrome. Superb Blog!

Can I just say what a relief to seek out somebody who actually is aware of what they’re talking about on the internet. You undoubtedly know the way to bring an issue to gentle and make it important. More individuals need to learn this and understand this aspect of the story. I cant consider you’re not more widespread since you undoubtedly have the gift.

Hey there, You’ve done a fantastic job. I?ll definitely digg it and personally recommend to my friends. I am confident they will be benefited from this website.

You made some first rate factors there. I appeared on the web for the problem and found most people will go together with along with your website.

I will immediately grab your rss as I can not find your e-mail subscription link or newsletter service. Do you have any? Please let me know in order that I could subscribe. Thanks.

I can’t believe how amazing this article is! The author has done a fantastic job of conveying the information in an engaging and informative manner. I can’t thank her enough for providing such precious insights that have definitely enriched my understanding in this subject area. Kudos to him for crafting such a gem!

I just added this blog to my google reader, excellent stuff. Cannot get enough!

Howdy, i read your blog occasionally and i own a similar one and i was just wondering if you get a lot of spam feedback? If so how do you protect against it, any plugin or anything you can recommend? I get so much lately it’s driving me crazy so any assistance is very much appreciated.

Pretty section of content. I just stumbled upon your weblog and in accession capital to assert that I acquire in fact enjoyed account your blog posts. Any way I?ll be subscribing to your augment and even I achievement you access consistently rapidly.

Hi, Neat post. There is a problem with your web site in internet explorer, would check this? IE still is the market leader and a huge portion of people will miss your excellent writing due to this problem.

hi! I like your writing very much! share we communicate more about your article on AOL? I need an expert on this area to solve my problem. May be that’s you! Looking forward to see you.

Hiya! I just would like to give a huge thumbs up for the good info you will have here on this post. I will be coming back to your weblog for extra soon.

Thanks for some other fantastic article. The place else may anyone get that type of info in such an ideal method of writing? I’ve a presentation next week, and I’m at the search for such information.

I think this is among the most important info for me. And i’m glad reading your article. But should remark on some general things, The site style is great, the articles is really great : D. Good job, cheers

Great ? I should certainly pronounce, impressed with your web site. I had no trouble navigating through all tabs as well as related information ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Reasonably unusual. Is likely to appreciate it for those who add forums or something, site theme . a tones way for your client to communicate. Nice task..

As I web site possessor I believe the content matter here is rattling fantastic , appreciate it for your hard work. You should keep it up forever! Good Luck.

Pretty part of content. I simply stumbled upon your web site and in accession capital to say that I acquire in fact loved account your blog posts. Anyway I?ll be subscribing to your feeds or even I fulfillment you access persistently quickly.

I think one of your commercials caused my browser to resize, you might want to put that on your blacklist.

Can I just say what a relief to search out somebody who truly is aware of what theyre speaking about on the internet. You undoubtedly know the right way to bring a problem to light and make it important. Extra folks need to learn this and perceive this facet of the story. I cant believe youre no more popular because you positively have the gift.

Hello just wanted to give you a quick heads up. The text in your post seem to be running off the screen in Opera. I’m not sure if this is a formatting issue or something to do with browser compatibility but I figured I’d post to let you know. The design look great though! Hope you get the problem fixed soon. Cheers

I appreciate, cause I found just what I was looking for. You have ended my four day long hunt! God Bless you man. Have a nice day. Bye

It is in point of fact a great and helpful piece of information. I?m happy that you simply shared this helpful information with us. Please stay us up to date like this. Thanks for sharing.

very good submit, i definitely love this web site, carry on it

Thank you for another informative blog. Where else could I get that kind of info written in such an ideal manner? I have a challenge that I’m just now operating on, and I’ve been at the glance out for such information.

I?ll right away grab your rss as I can not find your e-mail subscription link or newsletter service. Do you’ve any? Please let me know so that I could subscribe. Thanks.

Hey! Quick question that’s totally off topic. Do you know how to make your site mobile friendly? My web site looks weird when viewing from my apple iphone. I’m trying to find a template or plugin that might be able to correct this problem. If you have any suggestions, please share. Cheers!

Incredible! This blog looks just like my old one! It’s on a totally different topic but it has pretty much the same page layout and design. Superb choice of colors!

Hello there, just became aware of your blog through Google, and found that it’s truly informative. I am going to watch out for brussels. I’ll appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

Thanks , I have just been searching for information approximately this topic for a while and yours is the best I have came upon till now. However, what in regards to the bottom line? Are you positive concerning the supply?

Good ? I should definitely pronounce, impressed with your web site. I had no trouble navigating through all tabs as well as related info ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Quite unusual. Is likely to appreciate it for those who add forums or something, web site theme . a tones way for your customer to communicate. Nice task..

Someone essentially help to make severely posts I might state. This is the very first time I frequented your web page and up to now? I surprised with the research you made to make this particular publish extraordinary. Great job!

You can certainly see your expertise within the paintings you write. The world hopes for even more passionate writers like you who are not afraid to say how they believe. At all times follow your heart.

I?ve recently started a blog, the info you offer on this site has helped me tremendously. Thank you for all of your time & work.

Hello my friend! I wish to say that this post is amazing, nice written and include almost all significant infos. I?d like to see more posts like this.

you’ve an excellent blog here! would you wish to make some invite posts on my blog?

Oh my goodness! an amazing article dude. Thanks However I’m experiencing problem with ur rss . Don?t know why Unable to subscribe to it. Is there anyone getting equivalent rss problem? Anybody who is aware of kindly respond. Thnkx

Does your blog have a contact page? I’m having problems locating it but, I’d like to shoot you an e-mail. I’ve got some creative ideas for your blog you might be interested in hearing. Either way, great site and I look forward to seeing it expand over time.

Please let me know if you’re looking for a writer for your weblog. You have some really good posts and I believe I would be a good asset. If you ever want to take some of the load off, I’d really like to write some content for your blog in exchange for a link back to mine. Please shoot me an email if interested. Kudos!

I found your weblog site on google and examine a few of your early posts. Proceed to keep up the superb operate. I simply extra up your RSS feed to my MSN Information Reader. In search of forward to reading extra from you afterward!?

Fantastic beat ! I wish to apprentice while you amend your website, how could i subscribe for a blog web site? The account aided me a acceptable deal. I had been a little bit acquainted of this your broadcast offered bright clear concept

great post, very informative. I wonder why the other experts of this sector don’t notice this. You must continue your writing. I’m sure, you’ve a huge readers’ base already!

WONDERFUL Post.thanks for share..more wait .. ?

I discovered your blog web site on google and test just a few of your early posts. Proceed to maintain up the excellent operate. I simply further up your RSS feed to my MSN News Reader. Searching for ahead to studying more from you in a while!?

Hi there! Quick question that’s entirely off topic. Do you know how to make your site mobile friendly? My web site looks weird when viewing from my iphone 4. I’m trying to find a template or plugin that might be able to resolve this problem. If you have any recommendations, please share. Thank you!

Greetings! Very useful advice within this post! It is the little changes which will make the most important changes. Many thanks for sharing!

I blog often and I truly appreciate your content. This great article has really peaked my interest. I will bookmark your blog and keep checking for new information about once per week. I opted in for your Feed as well.

Having read this I believed it was extremely enlightening. I appreciate you spending some time and effort to put this information together. I once again find myself personally spending a significant amount of time both reading and posting comments. But so what, it was still worthwhile.

Saved as a favorite, I really like your website!

After checking out a handful of the blog posts on your website, I truly like your way of writing a blog. I book marked it to my bookmark website list and will be checking back in the near future. Please visit my website as well and let me know your opinion.

This website was… how do you say it? Relevant!! Finally I’ve found something that helped me. Thanks!

This really answered my drawback, thank you!

You ought to be a part of a contest for one of the most useful sites on the net. I’m going to highly recommend this web site!

I have to thank you for the efforts you’ve put in penning this blog. I’m hoping to check out the same high-grade blog posts by you in the future as well. In fact, your creative writing abilities has inspired me to get my very own blog now 😉

There is certainly a lot to find out about this topic. I like all the points you’ve made.

Good article. I’m experiencing some of these issues as well..

I need to to thank you for this fantastic read!! I certainly enjoyed every bit of it. I have got you bookmarked to check out new stuff you post…

Excellent blog you have got here.. It’s hard to find high-quality writing like yours nowadays. I honestly appreciate individuals like you! Take care!!

You made some really good points there. I checked on the internet for more info about the issue and found most individuals will go along with your views on this web site.

You have made some good points there. I looked on the net to find out more about the issue and found most individuals will go along with your views on this web site.

Awesome website you have here but I was wondering if you knew of any forums that cover the same topics discussed in this article? I’d really like to be a part of online community where I can get comments from other knowledgeable people that share the same interest. If you have any suggestions, please let me know. Thanks!

Excellent blog post. I definitely love this website. Keep it up!

Hi! Quick question that’s totally off topic. Do you know how to make your site mobile friendly? My website looks weird when browsing from my apple iphone. I’m trying to find a theme or plugin that might be able to fix this issue. If you have any suggestions, please share. Many thanks!

An outstanding share! I’ve just forwarded this onto a coworker who had been conducting a little research on this. And he actually bought me breakfast because I discovered it for him… lol. So allow me to reword this…. Thank YOU for the meal!! But yeah, thanks for spending the time to discuss this subject here on your site.

You have made some really good points there. I checked on the net to learn more about the issue and found most individuals will go along with your views on this website.

Hi there, I do believe your site could be having internet browser compatibility problems. Whenever I take a look at your site in Safari, it looks fine but when opening in IE, it has some overlapping issues. I simply wanted to give you a quick heads up! Besides that, great blog!

Saved as a favorite, I really like your site.

Thank you a bunch for sharing this with all of us you actually recognise what you are speaking about! Bookmarked. Please additionally talk over with my website =). We could have a hyperlink alternate agreement between us!

I could not resist commenting. Well written!

The subsequent time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to read, however I really thought youd have something fascinating to say. All I hear is a bunch of whining about one thing that you could fix in the event you werent too busy on the lookout for attention.

bookmarked!!, I love your blog!

I like looking through a post that can make people think. Also, thank you for permitting me to comment.

This site truly has all of the information and facts I wanted about this subject and didn’t know who to ask.

This is a topic which is near to my heart… Take care! Exactly where are your contact details though?

This is a good tip particularly to those new to the blogosphere. Simple but very precise info… Thank you for sharing this one. A must read post.

A round of applause for your blog article.Much thanks again. Keep writing.

After looking into a number of the blog posts on your web page, I honestly like your technique of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Please visit my website as well and tell me how you feel.